The Greek Space Mission

Summary: The si-Cluster in Athens has established itself as a key actor within the regional industrial ecosystem. The cluster cooperates with and is used by regional authorities in the development of the Smart Specialisation Strategy (S3) and in facilitating regional industrial transition. Since its establishment in 2009, the cluster became an important institution in the region, bringing together around 80% of the approximately 100 space actors in Greece. The cluster contributes to the growth of the sector and employment numbers, focussing not only on the Greek space ecosystem but also on technology transfer into non-space related sectors. By facilitating the implementation of the region’s S3 strategy, the si-Cluster contributes significantly to the realisation of the region’s digital transition whereas at the European level it is involved in helping promote industrial transition and resilience by actively participating in various EU-funded projects.

The Attica Region

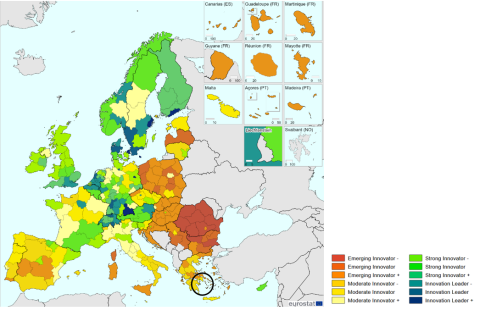

Located in the centre of Greece, the administrative region of Attica encompasses the Athens metropolitan area, which is the capital of Greece, and furthermore the cities of Elefsina, Megara, Laurium, and Marathon. In addition, a small part of the Peloponnese peninsula and the islands of Salamis, Aegina, Angistri, Poros, Hydra, Spetses, Kythira, and Antikythera are also part of this region. The Attica region is home to more than 3.8 million people[1] and contains approximately one third of Greece’s total population, therefore, it is the most populated and most urbanised region in Greece. Over 1.9 million employees work in more than 345,000 companies in the region[2]. According to the EU’s Regional Innovation Scoreboard 2023, Attica is a Moderate Innovator with increasing innovation performance over time[3].

Regional Innovation Scoreboard 2023. Source: European Commission

[1] Smart Specialisation Platform 2023. https://s3platform.jrc.ec.europa.eu/region-page-test/-/regions/EL30#s3p…

[2] Enterprise Greece 2022. https://www.enterprisegreece.gov.gr/en/synergassia-regional-compass/eco…

[3] Regional Innovation Scoreboard 2021. https://ec.europa.eu/assets/rtd/ris/2023/ec_rtd_ris-regional-profiles-g…

Industrial Ecosystems and Relevant Strategies

The economy in the region of Attica is the most diversified in the country and comprises a variety of significant sectors: commerce, financial services, transportation, information technologies, health and social services as well as leisure and recreation[1]. Measured by turnover, the following sectors are economically important in the region: wholesale and retail, processing, energy, financial and insurance plus transport and storage[2].

In the previous regional smart specialisation strategy (2014-2020), particular focus was placed on the following economic sectors: sustainable economy (e.g. smart cities, agri-food and health), blue economy (maritime industries, fisheries, logistics and energy) and creative economy (e.g. arts, culture, business and technology)[3][4].

Currently, Attica is in an ongoing Entrepreneurial Discovery Process (EDP) of the Smart Specialisation Strategy. In this process, the regional priorities and dynamics have been mapped to the eight main fields of the national S3. The priorities in 2021 – 2027 therefore are:

- Biosciences, Health and Pharmaceuticals

- Environment & Circular Economy

- Transport & Logistics

- Agri-Food Value Chain

- Materials, Construction and Industry

- Tourism, Culture and Creative Industries

- Digital Technologies

Another important strategy in the region, focusing on the city of Athens, is the „Athens Resilience Strategy for 2023“. This includes the presentation of the challenges and 4 fields of action for the capital.

[1] Sotiris P. 2016. The "Smart Specialisation Strategy" in the Region of Attica. https://www.athenssocialatlas.gr/en/article/smart-specialisation/

[2] Enterprise Greece 2022. https://www.enterprisegreece.gov.gr/en/synergassia-regional-compass/economic-activity/attica#electricity-natural-gas-steam-and-air-conditioning-supply

[3] Sotiris P. 2016. The "Smart Specialisation Strategy" in the Region of Attica. https://www.athenssocialatlas.gr/en/article/smart-specialisation/

[4] European Commission 2023. Smart Specialisation Platform. Attica (EL 30). https://s3platform.jrc.ec.europa.eu/region-page-test/-/regions/EL30

STRATEGIC CHALLENGES

Strategic challenges mentioned by the institutions consulted in regard to the S3 strategy include both external factors and risks:

- sustainable and inclusive growth,

- sustainable mobility,

- climate change,

- healthy aging,

- demographics and well-being,

- increased international and interregional collaborations,

- curbing “brain drain” and “intellectual property drain”,

- reskilling/upskilling to support industrial and digital transition, as well as

- the transformation of public administration.

CLUSTER POLICY and CLUSTERS

The first programme to promote clusters in Greece was implemented under the Community Support Framework (CSF) 1994-1999 and has continued in the following programming periods up to this day. Furthermore, cluster policy in Greece has been implemented through European structural funds.

10 clusters are currently operating in the region of Attica: Space Technologies and Applications Cluster (si-Cluster), Gaming and Creative Technologies & Applications Cluster (gi-Cluster), Nano/Microelectronics Systems and Applications Cluster (mi-Cluster/HETIA), Cluster in Digital Technologies in the Tourism & Culture Sectors, Hellenic BioCluster (HBio), Hellenic Photonics Cluster (HPhos), Hellenic Mobile Cluster (SEKEE), Sustainable Construction, Buildings, and Infrastructure (e-CODOMH), Greek Fintech Cluster as well as Asklepieia Health Cluster on Health and Wellness tourism.

The new Regional Operational Programme „Attica“ 2021-2027 promotes the support of clusters for the transition to a green and digital economy. The following categories comprise the funding of the work of clusters in the region:

- Creation and development of research and innovation clusters (12m€)

- Strengthening the cooperation of public and private entities of the regional research and innovation ecosystem for the development of innovative products/services, with an emphasis on industrial research and experimental development in Attica's areas of specialisation (35m€)

- Strengthening clusters to increase competitiveness and resilience, through the cooperation of companies active in related or complementary sectors (4m€)

si-Cluster

AdobeStock

AdobeStock

The Athens-based Research and Innovation Organisation Corallia founded the si-Cluster together with the Hellenic Association of Space Industries as a joint initiative in 2009. The si-Cluster is an innovation cluster operating in the field of space technologies and applications in Greece. It follows the vision of maintaining a world-class cluster in these fields and placing Greece on the global map of this highly developing and competitive market.

The cluster is largely financed by membership fees and to a lesser extent by regional and national funding programmes.

MAIN FEATURES

The si-Cluster was founded in 2009 with 11 members and has now more than 80 members. 70% of si-Cluster members are located in the Region of Attica. Other areas of concentration are the Region of Western Greece (12%) and the Region of Macedonia (9%).

The si-Cluster represents an industry with over 3,000 employees and a cumulative turnover of 250 million euros. Moreover, it acts not only in the space ecosystem but also in other sectors of the economy, such as agriculture, transport, environment, defence, etc.

In the si-Cluster, 61% of the members are companies, 25% are academic and research institutions and the rest are other types of organisations. Of the companies, 8% are large, 20% are medium, 59% are small and 13% are micro.

The members of the cluster are positioned in different segments of the value chain and represent an important part of the value chain of space technologies and applications. They are operating in the following sectors:

- 42% in the upstream sector (technologies developed for actual physical satellites, e.g. robotics, materials, electronics)

- 39% in the downstream sector (technologies and services related to the use of data and signals from satellite systems, e.g. location, navigation and time signals or telecommunication signals)

- 15% in the midstream sector (technologies and services related to the operation of satellites)

The cluster management team consists of five well-qualified staff members (three full time equivalents (FTE)). The cluster’s work is based on a quadruple helix structure in which research facilities, industry, government and the wider community cooperate to add value in the country and in the specific thematic area. In 2015, the si-Cluster received the Gold Label certification from the European Commission's European Secretariat for Cluster Analysis. At present, Crallia, coordinator of si-Cluster, is certified with the ISO 9001:2015 quality management system standard.

A particular feature of the si-Cluster is that it is established and managed – together with the gi-cluster and the mi-cluster – by Corallia. Corallia was established in 2005 as the first organisation in Greece responsible for management and development of innovation ecosystems[1]. As management organisation of the si-Cluster, Corallia works at strategic level and coordinates the preparation of the annual report and strategy for the si-Cluster, including analysis of global, European and national space trends in the upstream, midstream and downstream sectors, SWOT analysis, strategy and implementation plan.

The strategy of the si-Cluster includes the following goals:

- Further development of the national space programme

- Establishment of a national space infrastructure and facilities

- Increased Greek participation in ESA/EUSPA/HORIZON programmes

- Establishment of bilateral relations and cooperation with other European countries

Participation of Greek space components/products in space missions

[1] Corallia 2023. https://corallia.org/en/about-en/

SERVICE PORTFOLIO

Digital industrial transition and building up resilience are equally important objectives of the cluster initiative. Thereby, the si-Cluster supports not only the Attica Region but the entire Greek Space ecosystem with various services since 2009, most notably:

- business development,

- incubation activities,

- entrepreneurship support,

- technical advice,

- mediation on technology transfer,

- spin-in of non-space technology and actors in the space commercial area,

- spin-out of space products to non-space markets,

- specific trainings, and organisation of networking events;

- events with a high reach as well as commercial roadshows in Europe and worldwide.

Every year, the si-Cluster conducts an inventory of the Greek space ecosystem, value chains, activities and technologies in Greece, leading to the Greek Space Catalogue and a bottom-up contribution for the Greek Space Strategy document and implementation plan.

INNOVATION ECOSYSTEM

In order to provide an institutional framework for the realisation of the Greek Space Industry vision, the si-Cluster has strategic partnerships with public and institutional bodies. Against this background, si-Cluster works closely with the Ministry of Digital Governance, the Ministry of Defence, the Ministry of Development, the Ministry of Education, the Ministry of Foreign Affairs, the Ministry of Maritime Affairs and Island Policy, the Attica Region, the European Space Agency, Enterprise Greece, Elevate Greece, and many more.

Through education and information activities, the si-Cluster was able to reach out to a wider ecosystem. This includes citizens, student organisations and volunteers, the Space Generation Advisory Council, the Greek NewSpace Society, Space Innovation, Beyond Robotics, and many more.

TRANSITION POLICIES and EUROPEAN PROGRAMMES

At the moment, the Smart Specialisation Strategy (S3) is being revised in the Attica region. The si-Cluster is involved in this process in various ways: as a member of the working group, identifying potential for improvement and priorities to jointly develop an action plan.

In the phase of the implementation of the regional innovation strategies, the cluster is involved by actively responding to calls related to the S3 – in order to develop products and services driving the scope of the strategy.

The reasons for the InnovationCenter of Attica Region, which officially coordinates the region’s S3 process, to involve the si-Cluster in the development and implementation of S3 are manifold; in particular, the cluster’s good unterstanding of the region and its involvement in the dynamics of the sectors, its willingness to serve effective points and measures as well as its enterpreneurial mindset that helps partners find more effective ideas and plans. By facilitating the implementation of the region’s smart specialisation strategy, the si-Cluster contributes significantly to the realisation of the region’s digital transition. The orientation of the cluster is the horizontal economy, focussing on helping other ecosystems with their involvement (e.g. in the agriculture sector by providung drones, data, weather information). At the European level the si-Cluster is involved in helping promote industrial transition and resilience by actively participating in various EU-funded projects.

These include among other:

- Participation in EC-funded projects like NEPTUNE, S3FOOD, UFO, GALATEA, GALACTICA, INTRANSIT, SURE5.0, with the aim of developing new cross-sector and cross-border industrial value chains related to space technologies, applications and data, and supporting European SMEs.

- Strong links and MoUs with European clusters (Aerospace Valley, Apulian DTA, TERN, SkyWin, MAC, MLC ITS EUSKADI, POLE MER MEDITERRANEE, SPACE PL, WATER INNOVATION ACCELERATOR, MARINE SOUTH EAST, TECHNOLOGICAL CORPORATION OF ANDALUSIA/CTA, MINALOGIC, AVIATION VALLEY, CEAGA, SAC, AIMEN, ANFIA) and ESA BICs (ESA BIC Sud France, BIC LAZIO, ESA BIC Hessen & Baden-Württemberg, Science Park Graz, etc.), and other innovation and space-related organisations (FONDAZIONE E. AMALDI, EBN, EARSC, SME4SPACE, NEREUS, EURISY, etc.).

- Founding member of European Strategic Cluster Partnerships (ESCPs) like SPACE2IDGO and SPACE2WAVES in the space downstream applications sector. The si-Cluster was awarded with the ESCP-4i label by the EC.

- Member of the European Network of Defence-related Regions (ENDR), in which various important actors in the security and defence sector are represented.

- Furthermore, it is a member of the METASTARS Eurocluster[1]. METASTARS helped the si-Cluster become well known, particitpate in EU projects and getting involved in the economic cascade. Their funding of projects helped to support companies in the space ecosystems for example to establish strategic cooperations and upgrade products.

- Moreover, EU frameworks and project fundings have helped the cluster in the field of internationalisation, as well as with branding and marketing for the si-Cluster. They have also helped the country and the region by bringing new technologies and value chaines in and by developing infrastructure.

[1] Metastars is part of Euroclusters, a network of cross-sectoral, interdisciplinary and trans-European strategic initiatives of industrial clusters and other economic actors launched in 2022 by the EC (ECCP 2023. Euroclusters. https://clustercollaboration.eu/euroclusters).

IMPACT

Greece has an emerging space industry and over the last 15 years, a space ecosystem and supporting networks have been formed with the active participation of Corallia, Hellenic Association of Space Industry (HASI) and other private and public organisations in the quadruple helix. The si-Cluster includes around 80% of the approximately 100 space actors in Greece. The ESA Business Incubation Centre[1], also managed by Corallia, is the only space incubator/accelerator in Greece and supports the creation and introduction of five new space start-ups per year into the ecosystem and aims to grow the entire ecosystem by 25% within five years.

The space sector, an infant industry in Greece that has been noticed only in the last couple of years and became part of the regional policies, is a fast growing sector with a significant increase in the number of start-ups and entrepreneurs. In order to track the impact of the si-Cluster in this environment, the si-Cluster management is about to develop target values for specific monitoring indicators.

At this stage, it has been observed that the sector has grown by 6.5% over the last 10 years and employment has increased by 17% since last year.

Against this backdrop, the si-Cluster has strengthened other essential elements with targeted measures that have contributed to more than 20% of highly qualified managers having a master's or doctoral degree and a 50% increase in collaboration with academic institutions to create joint practices, dissertations, doctorates, etc. Futher impacts and results of the clusters’ work and the effectiveness and impact of funding measures are expected to be visible in the following years.

[1] European Space Agency 2021. ESA helps Greece to boost its space investments. https://www.esa.int/Applications/Connectivity_and_Secure_Communications/ESA_helps_Greece_to_boost_its_space_investments

Lessons Learned and Transferability

The si-Cluster has established itself as a key actor within the regional industrial ecosystem. It played a major role in the development of the space ecosystem in Greece. Altough the cluster is still developing indicators to measure its impact, a positive development of the economic growth and employment in that sector was noted in the region and across Greece.

The cluster's cooperation with the region has been successful over the years and, at a higher level the cooperation between public and private sector led to the establishment of a national space programme. Moreover, with the region’s support there has been an active involvement in European programmes, projects and initiatives.

Against the background of supporting green and digital transformation and building regional resilience, it is understood in the region that clusters can be pioneers in implementing change and bring the rest of the ecosystem along as they hold their trust. It was also noted that the region and the clusters need to be a team.

The si-Cluster's contribution is particularly important in the area of digital transition, as it acts horizontally in different economic fields and supports other ecosystems through their engagement. In the area of green transition, the cluster noted that policy makers need to take more action and use clusters as tools to implement policies in different ecosystems.

RECOMMENDATIONS

The case of the si-Cluster illustrates how a constructive relationship between a region and a cluster can lead to successful developments in an economic sector. The example of space sector shows the influence the work of the cluster with the support of the region has had on the development of an ecosystem and how economic key figures develop positively. Due to the horizontal orientation of the cluster and services in the field of technology transfer, other economic sectors also benefit from the cooperation. Moreover, it shows the importance of national and regional policies and policy support programmes that enable a framework for these developments. Finally, this example also shows the relevance of international networking and funding programmes, which also have a considerable influence on the development of ecosystems in the regions.