Green Transition in the Retail Industry

Summary: While the regional ShopExpertValley cluster is not among the region’s five prestigious Pôles de Compétitivité, the small retail cluster manages to facilitate green and digital industrial transition in the Centre-Val de Loire region by offering a targeted and innovative service portfolio to its cluster members. Although the cluster is not eligible for financial support through a national cluster support scheme, the Regional Council provides financial support to cover for operating expenses under its “research, development and innovation (RDI)” scheme. Moreover, the region makes available support through calls for innovation projects, mainly supported by ERDF, which the Council implements in its capacity as managing authority.

The Centre-Val de Loire Region

The Centre-Val de Loire region is home to 2.57 million people and is the location of more than 52,000 companies, dominated by small and medium-sized enterprises (SMEs). With its strong industrial base, bringing together more than 5,500 industrial units, it is France’s 4th largest industrial region in terms of industrial employment rates. The region is rather heterogeneous with a highly industrialised northern part as a result of decentralisation from the Paris region in the 1970s and a more agricultural dominated south. The regional research and innovation ecosystem has an important representation of national research laboratories and organisations, including three main higher education institutions, the University of Orléans, the University of Tours and the INSA-Centre Val de Loire.[1]

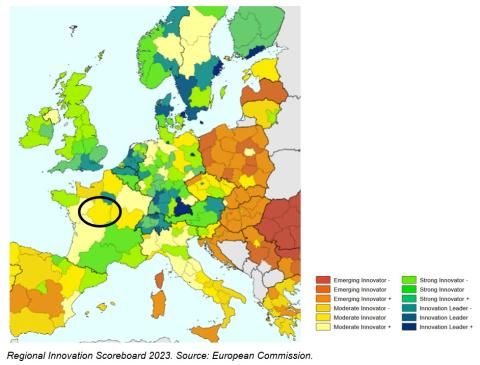

According to the EU Regional Innovation Scoreboard 2023, Centre-Val de Loire (FRB) is a Moderate Innovator although innovation performance has decreased over time (-5.4%).

The Centre-Val de Loire region is pursuing an ambitious specialisation policy aimed at enhancing skills, particularly in research and development (R&D), and integrating innovation more effectively into its economic structure. The region has chosen, through its Research and Innovation Strategy for Smart Specialisation (RIS3), to strengthen its innovation ecosystems in sectors where it holds a competitive advantage (such as cosmetics, pharmaceuticals, tourism, etc.), while also investing in emerging fields related to sustainable development (such as environmental engineering, energy storage, etc.).

The region’s current economic, social and environmental development strategy (Schéma Régional de Développement Économique, d'Innovation et d'Internationalisation (SRDEII)), adopted in November 2022 and entitled Ambition 2030, highlights the “determination to position the region at the forefront of the fields of the future, driven by the services and industries of tomorrow, the ecological and energy transition and the responsible digital transition.”

[1] https://www.devup-centrevaldeloire.fr/media/2021/economie_centre_loire_…

INDUSTRIAL ECOSYSTEMS

The Centre-Val de Loire region is shaped by six dominant industrial ecosystems, which all encompass players from the smallest start-ups to the largest companies, from academia to research, service providers to suppliers: The main industrial sectors represented are:

- automotive (27,500 employees),

- aeronautics (24,000 employees),

- cosmetics (6,000 employees),

- the agri-food industry (12,000 employees),

- defense (20,000 employees), and

- health (13,000 employees).

The Loire axis constitutes a dynamic area in terms of employment, as it is highly service-oriented: there are three departmental capitals, including the region's two largest conurbations, Orléans and Tours, where shops and services are concentrated.

STRATEGIC CHALLENGES

The region’s current economic, social and environmental development strategy (Schéma Régional de Développement Économique, d'Innovation et d'Internationalisation (SRDEII)) addresses five challenges:

- meeting the challenge of employment, qualifications and skills in the face of fast-growing and profoundly changing needs

- accelerating the ecological and energy transition, a major lever for economic development

- relocating, diversifying, innovating and digitalisation: major challenges for tomorrow's economic performance

- boosting the local economy at the heart of the ecological transition, social well-being and regional development

- strengthening the collaborative and supportive role of all regional players

CLUSTER POLICY and CLUSTERS

The Centre-Val de Loire Regional Council considers cluster organisations important policy instruments for the implementation of the region’s strategic priorities. In addition, they are considered important in structuring the regional ecosystem and are expected to contribute to the concentration of resources and activities around the priority areas. Over the last few years, the Regional Council has supported or is supporting 13 clusters with a key distinction between Pôles de Compétitivité, which operate as part of a national cluster support policy,[1] and other regional clusters. In addition to these established structures, the Centre-Val de Loire region's SRDEII 2022-2028 set out plans to create “one or more sustainable mobility clusters focusing on the cycling, automotive and rail sectors at regional or inter-regional level”.

As of today, the region is home to the following five Pôles de Compétitivité:

- Cosmetic Valley: quality/traceability, microbiology, toxicology, biological effectiveness, cultural and sensory impacts, sustainable cosmetic

- Atlanpole Biothérapies: focuses on innovation in biomedicines

- Végépolys Valley: focuses on upstream and downstream innovations in plant production (competitiveness, quality, respect for the environment and the health of consumers and producers)

- Polymeris: the competitiveness cluster for rubber, plastics, and composites

- Smart Electricty Cluster S2E2: manufacturing, storage and electric networks, marine renewable energies, smart buildings, geothermal for new buildings, electronics for energy efficiency

Each year, the Pôles de Compétitivité present annual action programmes. Provided that the planned actions are in line with the political priorities set out by the regional authority in its SRDEII (current priorities include digital, ecological, energy and social transitions), they are eligible for technical and financial support from the region. In addition, the five Pôles de Compétitivité present in the region are members of the Regional Strategic Innovation Committee (CSRI) to facilitate the implementation of funding measures. The steering committee is committed to ensuring consistency between the development recommendations resulting from a bottom-up approach and the public policies implemented. In addition, the regional authority's departments maintain close links with the cluster teams, are present at various meetings and technical committees, and work together to organise specific meetings.

Alongside the five Pôles de Compétitivité, regional clusters provide an effective network for the region's main industries and sectors (traditional industries, pharmaceuticals, services, agri-food and agriculture, etc.):

- Polepharma

- Champs du Possible

- DREAM

- Nékoke (service sector innovation)

- AREA and Agreen Tech Valley (agri-food)

- Shop Expert Valley

- Digital Loire Valley

- Novéco

- Healthcare Loire Valley

- Pixel Players

- Aérocentre (aeronautical industry)

Regional clusters can receive grants from local authorities under the “research, development and innovation (RDI)" scheme. This scheme is used by the Centre-Val de Loire Regional Council to support “pôles d’innovation”, such as clusters, for operating expenses. A second type of public support is available to clusters through calls for innovation projects, mainly supported by ERDF, which the region implements in its capacity as managing authority.

In addition to the clusters supported by the Regional Council, there are clusters active in the region, which are not supported by the regional authority, such as FOOD Val de Loire, LORIAS and EDEN. In total, the Centre-Val de Loire region is home to a total of 19 clusters and Pôles de Compétitivité.

Source: CESER 2023: Clusters de demain. Une chance pour l’avenir de nos territoires en Centre-Val De Loire.

For the Regional Council, the involvement of clusters in regional development policies means that companies likely to be interested in certain support schemes are quickly identified. This allows them to be targeted more effectively. For example, at the beginning of 2024, the region set up a transition accelerator. With the help of clusters and the main partner in the operation, BPI, it was easier to find the 20 companies in the promotion.

[1] https://www.entreprises.gouv.fr/fr/innovation/poles-de-competitivite/presentation-des-poles-de-competitivite

THE RETAIL ECOSYSTEM

In general, the retail ecosystem, as defined by the EU’s industrial strategy, covers grocery and non-grocery retail, including e-commerce, and relevant wholesale; also suppliers, transportation, logistics, relevant real estate and consumers. The French retail market size was EUR 546.7 billion in 2022 and is expected to grow at a „Compound Annual Growth Rate“ (CAGR) of more than 1% during 2022-2027.[1] Accelerated by the COVID pandemic, the retail sector has invested heavily in e-commerce in the recent past and online sales now represent 12% of French purchases. However, with 90% of purchases still being made in physical points of sale, retail stores remain a key to the customer journey.[2] These stores must adapt to new consumer behaviours and integrate the advantages of technologies to improve the customer experience and optimise point-of-sale marketing.

In France, the economic sector of the development and equipment of retail space represents nearly 600 companies (excluding architecture, design and communication agencies, and craft trades), 20,000 direct jobs and EUR 4.5 billion in sales.[3] The Centre-Val de Loire region is home to the second largest number of these companies, and the first largest number of shopfitters, i.e. companies that manage the design, planning and fitting out of retail spaces, including shops, hospitality institutions, office spaces and department stores. The high concentration of these activities led to the creation of Shop Expert Valley, the only skills cluster dedicated to the point of sale in France.

[1] https://www.globaldata.com/store/report/france-retail-market-analysis/

[2] Source: https://shopexpertvalley.com/

Shop Expert Valley

In 2006, the high concentration of companies that manage the design, planning and fitting out of retail spaces (“shopfitters”) in the region led the local Chamber of Commerce and Industry and the regional Dev’up Economic Development Agency to create a business network for collaboration. Three years later, the regional cluster Shop Expert Valley took the form of an association under French law. It is a platform for information and exchange on the evolution of retail outlets and brings together companies involved in this particular part of the retail value chain, such as commercial architecture agencies, interior designers, manufacturers of signs, retail furniture, digital solutions, lighting solutions, security and service companies.

MAIN FEATURES

With the retail ecosystem, in general, encompassing different stakeholders from different vertical markets (“business verticals”), ShopExpertValley serves a horizontal market and brings together companies, in particular small and medium enterprises (SMEs) from various business verticals. The cluster counts 30 SMEs as well as some 50 associated partners, such as larger retail companies, which can get involved in the cluster’s innovation projects or networking events. While academia is not directly involved in the cluster, the Orléans School of Art and Design (ESAD) is an associated partner for potential innovation projects. The cluster management team consists of two experienced staff members. Overall governance is exercised by a board of directors made up of member representatives elected by the general assembly.

Work of the cluster management is based on a cluster strategy with the clear vision to be the one-stop shop for the development of physical retail stores. The cluster’s financial sources are diversified with 50% coming from private sources (membership fees, events and consulting services) and 50% from public sources (regional and ERDF funds).

SERVICE PORTFOLIO

Digital and green industrial transition in the region’s retail sector are the main objectives of the cluster initiative. In order to achieve these goals, the cluster management narrowed down its service portfolio to a number of targeted support activities:

- Networking (events and meetings)

- Communication/Business Intelligence (newsletters, market and trend studies, and industry and market databases)

- Business Development (participation in trade fairs)

- Innovation Workshops (on green and digital transition)

- Consulting Services (on de-carbonisation)

GREEN TRANSITION IN THE RETAIL INDUSTRY

In anticipation of future constraints (such as the long-term rise in energy prices and new regulations) and changing customer demands, retail networks are increasingly looking for an environmental approach to the design and equipment of their sales outlets. Shop Expert Valley has implemented various services to help specialist architects and design agencies, retail chains, solution providers and manufacturers in the sector: 1) The cluster carried out a study on the environmental challenges associated with store design, layout and equipment. It also provided information on regulations, labels and certifications as well as practice examples and testimonials from retailers and agencies. 2) Shop Expert Valley offers so-called “innovation workshops” for its members, in particular to facilitate green and digital transition. Applying a design thinking approach, it brings together cluster members to work on real life business cases and develop innovative, i.e. sustainable and digital solutions for physical “brick-and-mortar” stores, such as by using green materials, applying circular economy solutions, reducing energy consumption, etc. 3). The cluster offers a consulting service for its members (and beyond) on measuring and reducing carbon emissions.

Lessons Learned and Transferability

Although ShopExpertValley is not among the region’s five renowned Pôles de Compétitivité, the case shows how smaller regional clusters can facilitate green and digital industrial transition by offering a targeted and innovative service portfolio to its cluster members. While the regional ShopExpertValley cluster is not eligible for financial support through the national cluster support scheme, the Centre-Val de Loire region provides financial support to cover for operating expenses under its “research, development and innovation (RDI)” scheme. In addition, the region provides public support through calls for innovation projects, mainly supported by ERDF, which the council implements in its capacity as managing authority.