ANALYSIS OF SURVEY AMONGST THE ECCP PROFILED CLUSTER ORGANISATIONS: Executive Summary, July 2017

In June/July 2017, the European Cluster Collaboration Platform invited the profiled cluster organisations to a survey to learn about the users‘ satisfaction and enable the ECCP to provide better services to its members. Over 50%1 of the invited cluster organisations participated in the survey and more than 70% of the respondents are cluster organisations with over 5 years of experience. The survey looked for valuable feedback from the participants in relation to their internationalisation activities, their support of entrepreneurship and the use of - and expectations from - the ECCP services.

I. INTERNATIONALISATION

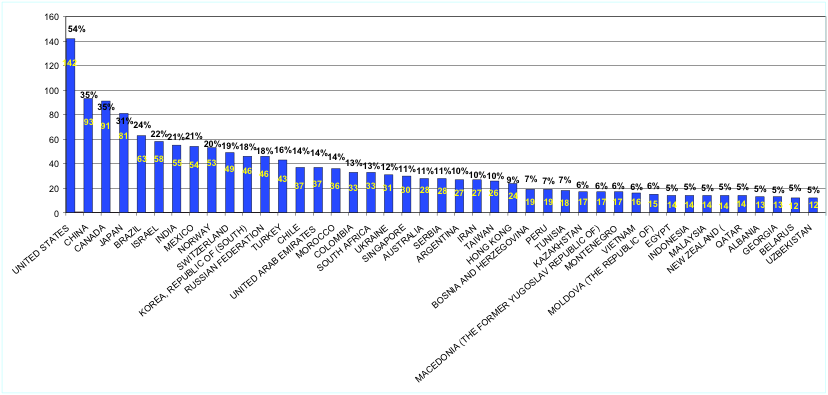

Since ECCP addresses and supports international cluster cooperation, it is very important to learn about the countries that European cluster organisations are interested to cooperate with beyond the European Union. It is an impressive number that 87% of the surveyed clusters target collaboration with countries from beyond European Union. The table below shows that the United States, China, Canada, Japan, Brazil, Israel, India and Mexico are the countries that more than 21% of the cluster organisations that answered this question2 are interested in.

When asked if they already cooperate with clusters from outside European Union, 34% of all answering clusters stated that they do cooperate and 152 (58%) that they do not. 21 participants (8%) did not answer. These figures show a high potential to help a large number of cluster organisations bridge the gap between interest in third countries and establishing collaboration with cluster partners there.

II. ENTREPRENEURSHIP

This survey introduced exceptionally a new category of questions referring to entrepreneurship, more precisely, on the need and benefits for including innovative start-ups in the cluster. 79% of the responding clusters answered positively, while 11% negatively and 10% did not provide any answers. Moreover, 73% consider that start-ups would enlage the scope of the available technologies in the cluster, 64% believe that start-ups would enlarge the scope of available business models in the cluster, 44% say that start-ups would enlarge the scope of available destination markets in the cluster, 63% state that start-ups would enhance attractiveness of talent into the cluster, 42% are in favour that start-ups should primarily emerge from spin-offs and joint-ventures from incumbent companies in the cluster but any others emerging otherwise are also beneficial if they are innovative and last but not least, 65% of clusters trust that start-ups that fill gaps in the cluster value-chain - whether or not innovative - are beneficial to the growth and development of the cluster.

III. ECCP SERVICES

It is noteworthy that the main interest of the registered cluster organisations lies in obtaining information on cluster-related calls, closely followed by obtaining information about cluster-related news, finding cooperation partners and staying updated with what happens in the international cluster community.

23% use the platform at least once a week or more often, 29% respondents use it 2-3 times in a month and 40% of them visit it once a month or once in a while. 48% of participants make use of the possibility to upload news/events/documents on their cluster organisation profile.

When invited to mark which ECCP services/offers have been most used during the last 6 months, the answers showed that 76% of participants accessed the news posted by ECCP, while 62% made use of the weekly digest and newsletters. Other services such as events, open calls, EU cluster initiatives related information, Mapping tool, Partner Search etc gathered each up to 50% of answers.

When asked how many companies from their cluster organisation directly/indirectly benefitted from the ECCP support actions, there were 69% of respondents indicating a percentage below 50%. The expectations of cluster organisations concerning funding opportunities (calls, financing instruments, links to investors/investment initiatives, but also training on how to succeed in European proposals) are high and in the future stronger efforts should be made by the ECCP to cover/introduce a wider range of such opportunities. Also the need for thematic newsletters, thematic webinars, email (news/calls/events/reports/etc.), alerts on a special theme, thematic structure of the calls published was very visible.

Based on the survey findings, we can say there is an upcoming important expectation from the ECCP: to offer and develop features of a social network model, supporting a work environment for clusters to network, as well as to have a structure of its content/functionality that serves the interests of the users. The platform grows in user numbers and content at a very high pace in very diverse directions, out of which internationalisation (which is the primary scope of the platform) is a major one. Although it is without doubt important and interesting for the clusters to have access to information from sectors outside their own, given the multitude/variety/complexity of the created content it becomes increasingly important for them to get to the information that is most relevant for their activities.

In general, the quality of all services tested by the respondents was considered as ranging from good to very good and excellent (over 70% of responses are in these 3 categories). 97% of the participants are satisfied/very satisfied with the services provided by the ECCP team.

1:More precisely: The survey was sent out to 592 profiled cluster organisations. 299 cluster organisations responded to the questionnaire (50.5%, compared to 42% in the January 2017 survey), out of which 262 fully completed the survey (44.3%) and 37 provided incomplete responses (meaning that not all the questions were answered) (6%).

2 :Out of the 262 answering participants, 34 (representing 13%) did not choose any country).